Jared Leonardi is a natural gas analyst for Enel X who works with customers to help plan their energy budgets and minimize price risk. Today he’s sharing his perspective on a question he’s been hearing from customers frequently: is inflation causing high natural gas prices, and will continued inflation drive prices even higher? To see more analysis from Jared and his team, read our Monthly Energy Market Insights – February’s Insights are featured here

Overview:

- Inflation remains high in America and globally, and there are concerns about increasing inflationary pressures in the near-term.

- The impact of inflation on natural gas should be minimal—natural gas instead is a leading indicator of inflation.

- Nevertheless, natural gas prices remain high, which has more to do with domestic supply and demand issues, despite the war in Ukraine or subsequent sanctions which seemingly should have a pricing impact.

At Enel X, we work closely on energy consulting and advisory with customers who are always working on long-term planning and budgets for their business. And to plan wisely, they need to know what to expect in energy prices. One concern we’ve often heard from customers recently is about inflation – in particular, how will inflation affect natural gas price?

Are natural gas prices high because of inflation?

Natural gas price, like most commodities, is driven by the market where it trades. This means gas prices are driven by the supply/demand of gas at a particular delivery location, and are independent from the wages, material costs, and associated variable costs in producing that gas. Thus, although those wages and other production factors in producing gas may be rising in tandem with inflation, they are not driving the price of natural gas.

Instead, prices are currently increasing because of a confluence of factors within the US, among them: long-running high demand, subsequently decreased storage, supply chain difficulties, pandemic effects, and geopolitical issues driving high international pricing and a high demand for exports. In the winter time, heat-load demand is one of the leading drivers of price. In the summer time, cooling demand dictates power-generation, which is a leading driver of demand during the season.

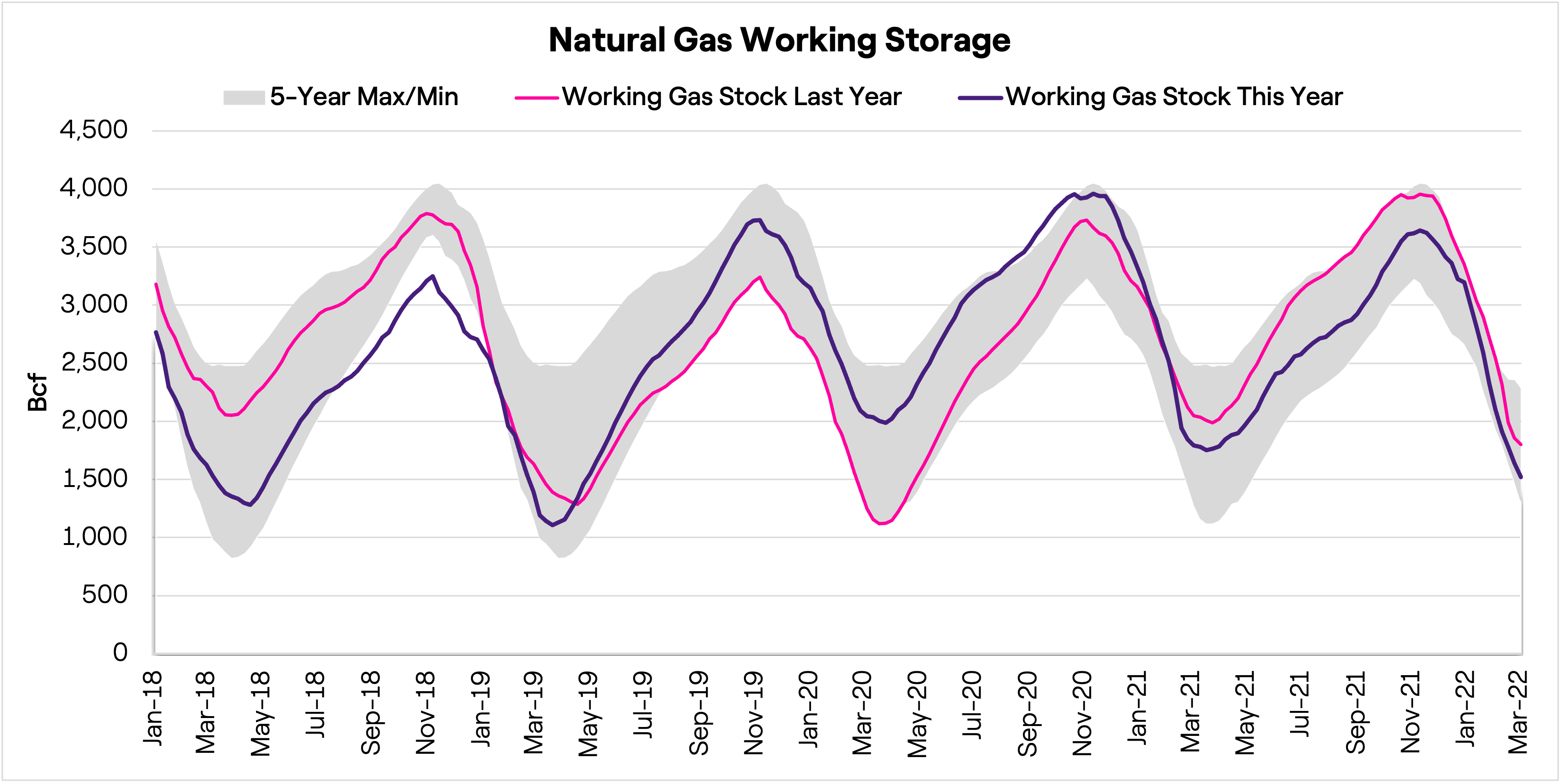

Below is the most recent natural gas storage report. The blue line indicates current storage levels. Levels are well below the 5-year average and even approaching the 5 year minimum number in storage, which are all bullish indicators for gas pricing.

This analysis can help us explain the price of natural gas through fundamentals, rather than inflation. In fact, high natural gas prices typically drive inflation, rather than inflation driving high natural gas prices.